Documenting Forest Ownership in Oregon

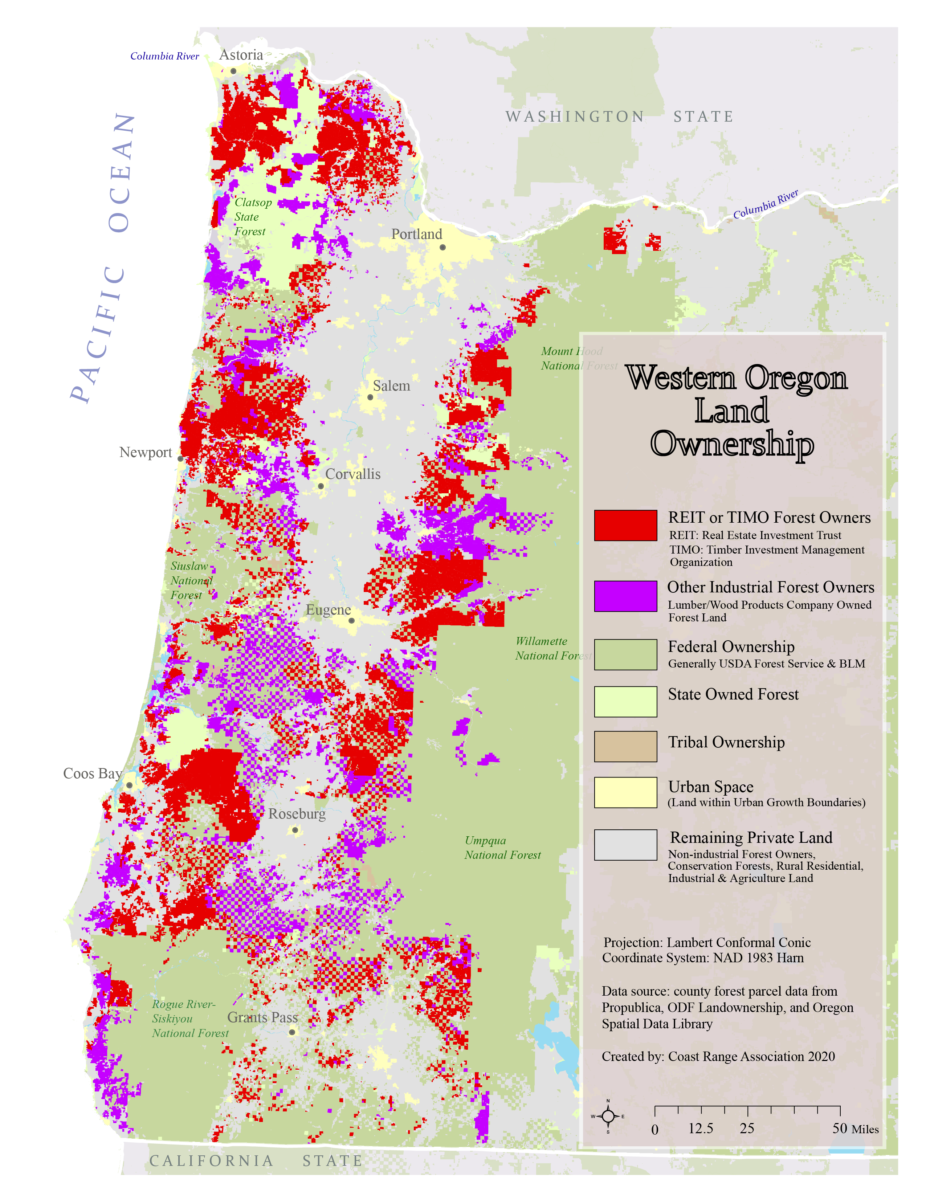

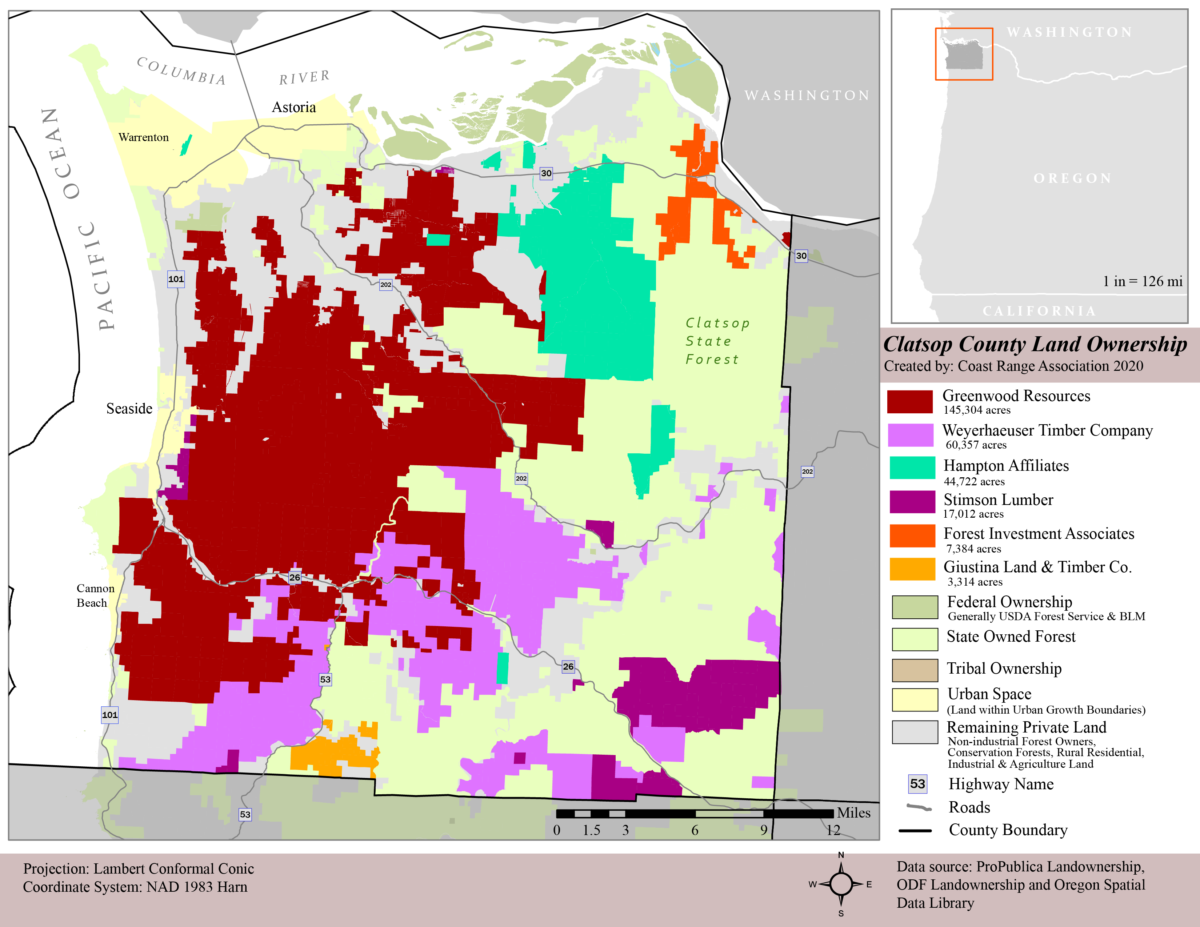

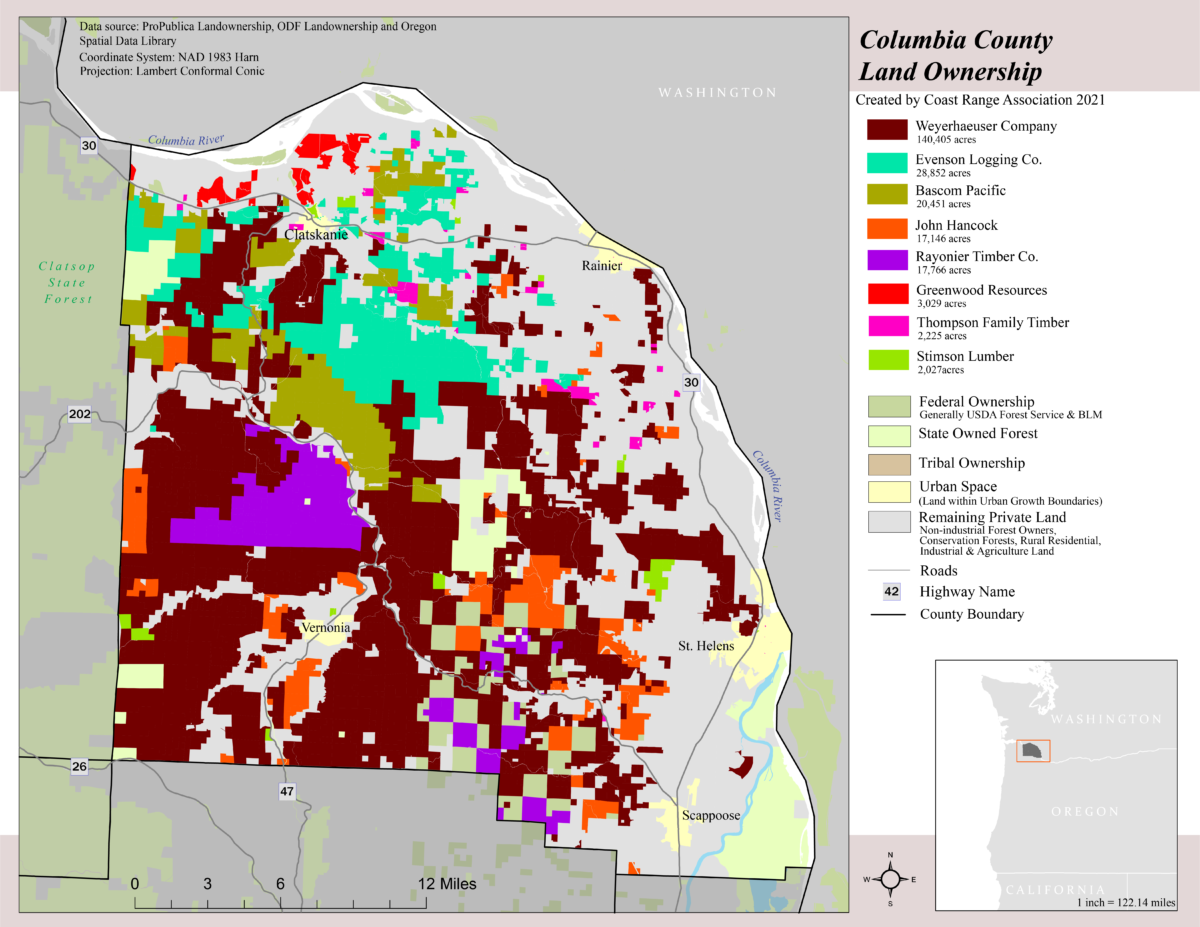

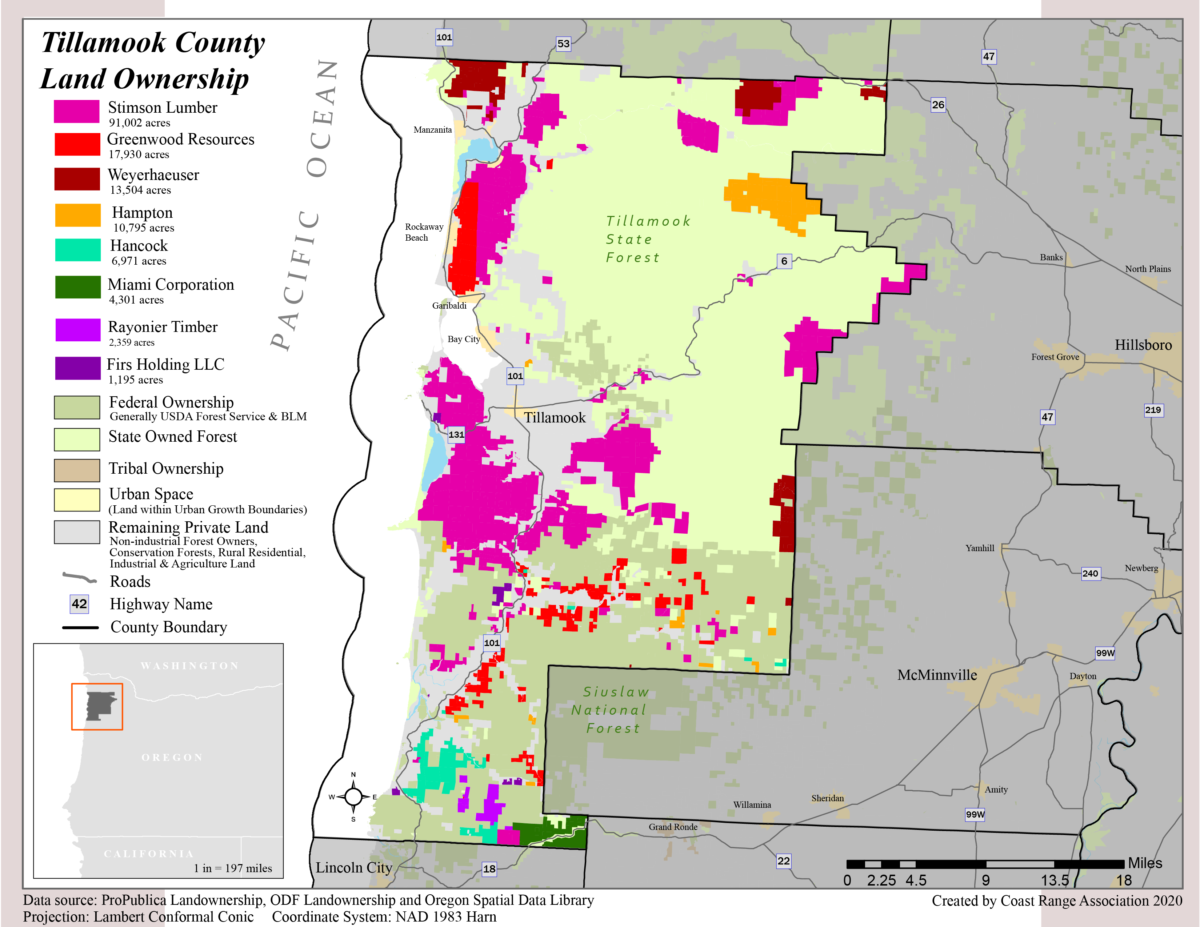

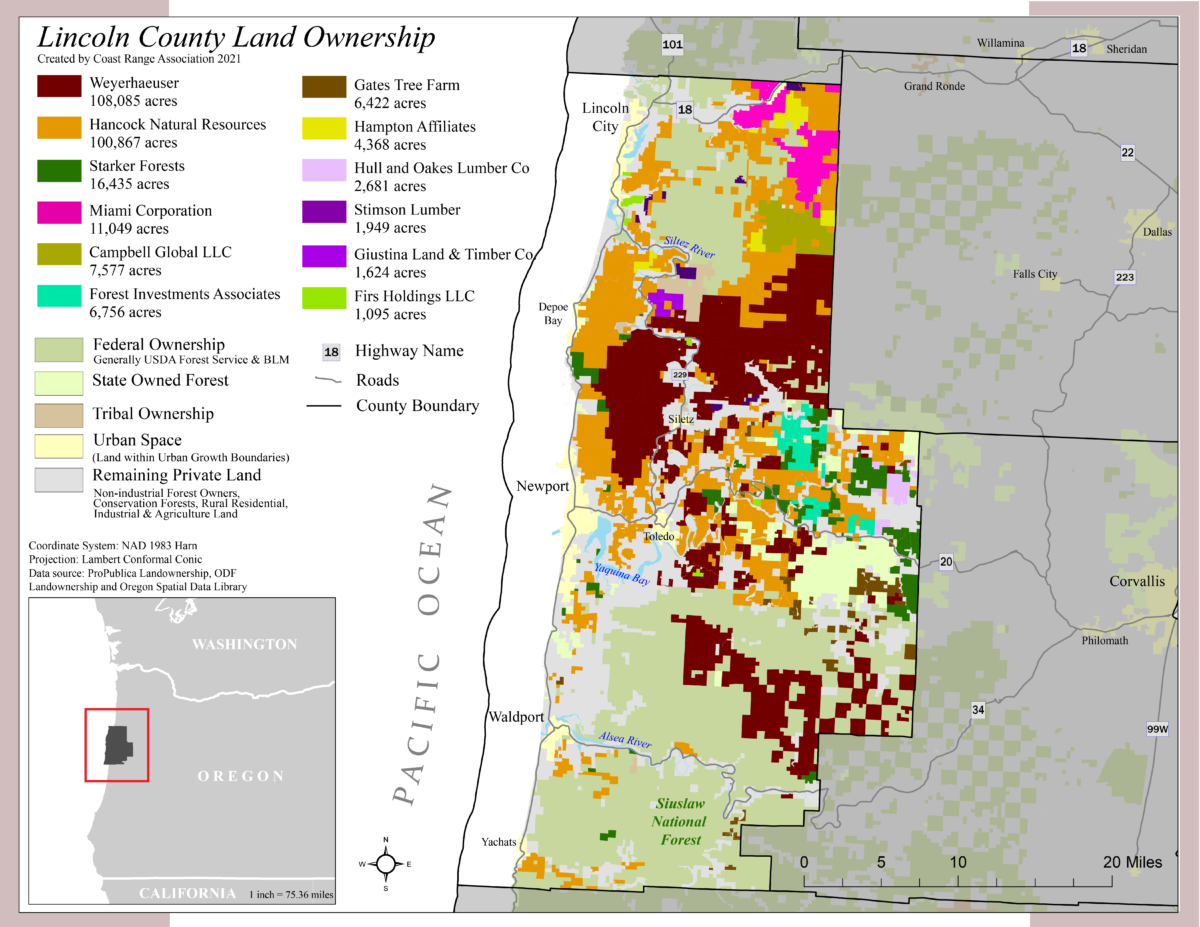

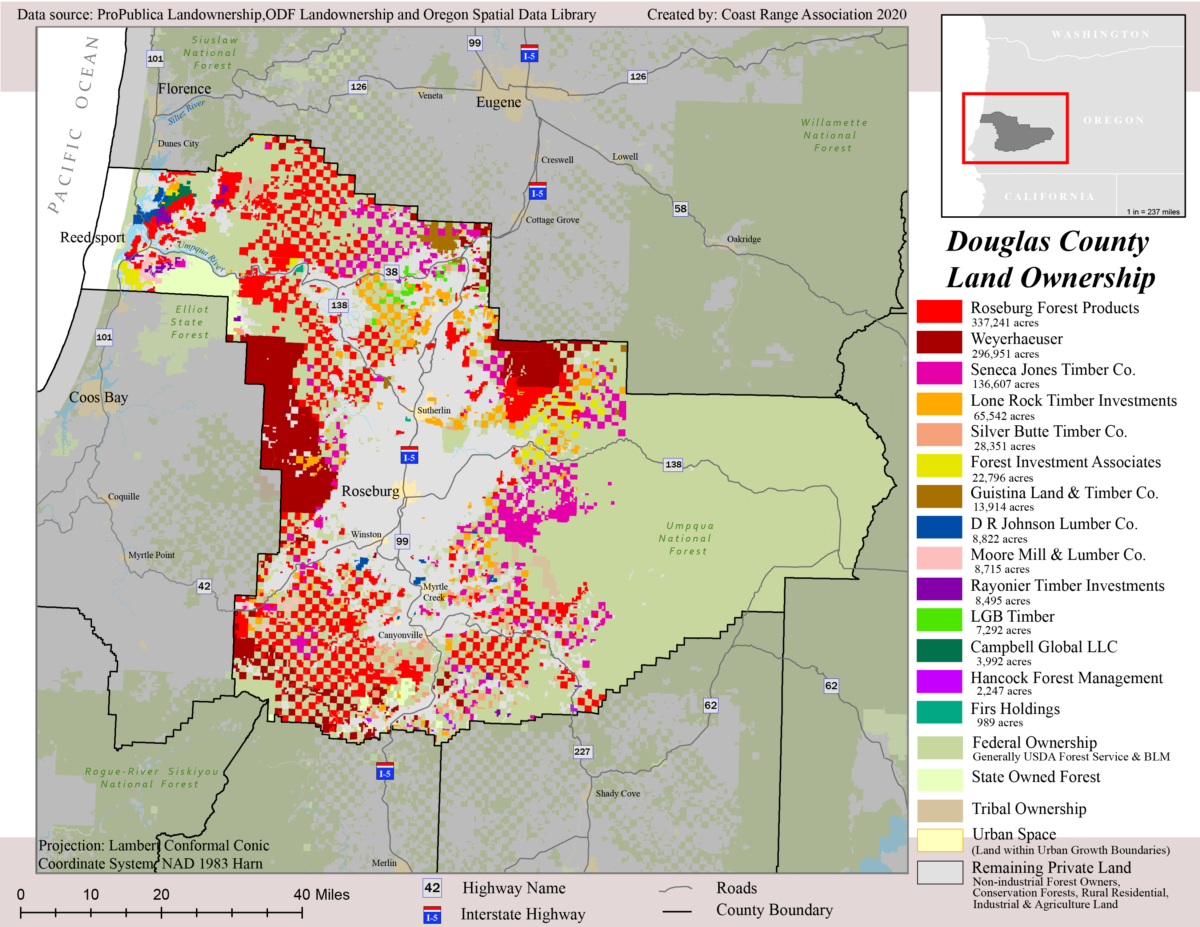

In 2020, the Coast Range Association released the first of a new set of corporate industrial ownership maps for Western Oregon (scroll to see individual coastal county maps).

Our first Wall Street Forestry mapping project, started in 2016, documented forest ownership in Western Oregon. This updated analysis looks at industrial owners at the county level. We wanted to know how much of the current forest ownership was in the hands of large corporations and how many of those corporate owners had become new tax avoiding Timber Investor Management Organizations (TIMOs) or Real Estate Investment trusts (REITs).

We found that 4.4 million acres are in private industrial ownership in Western Oregon. Approximately 62% of those industrial lands are in TIMO or REIT status, or 2.8 million acres. The maps show how these corporate owners dominate the forested landscape of Western Oregon. To get a deeper analysis, read our Climate & Oregon’s Industrial Forests: A Green New Deal Proposal to learn about the power corporate timber holds in Oregon, and the ambitious solutions to store carbon and improve people’s lives we propose.

The below maps are the first to be released for this new set of county by county maps. Click the map images to download, print and share with your friends and family.