Tax Avoidance by Big Timber: a Big Problem in Oregon

In 2016, the Coast Range Association researched big timber’s property and harvest taxes. There are three types of taxes timber companies might pay:

1. Property taxes

2. Harvest taxes

3. Income taxes

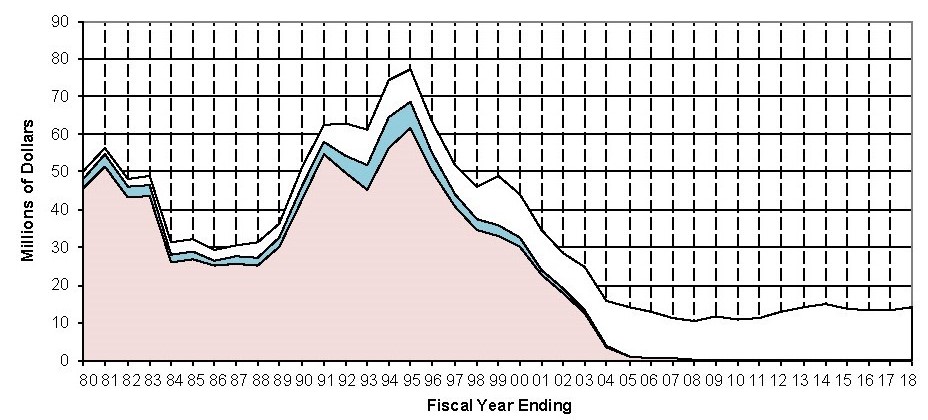

In the past, harvest taxes and property taxes were used to support local governments. Between 1990 and 2005 taxes on Oregon forest lands were completely changed. Taxes dramatically decreased for large industrial corporate owners. Our research indicates that industrial owners saw their local tax burden (property & harvest taxes) decline by over 80% in inflation adjusted dollars.

Oregon Timber Tax Collections

1980-2018

The first link below shows the data from the CRA’s analysis of property tax avoidance by the timber industry. We assembled property tax figures from a 2013 Legislative Revenue Office (LRO) report. We then recalculated the timber industry taxes paid for each year adjusted for inflation. We used the Bureau of Labor Statistics (BLS) Consumer Price Index (CPI) calculator. In this way taxes paid in the past can be compared to today’s payments in an apples to apples fashion.

Next you can download the Legislative Revenue Office report we used for our above analysis. See Appendix A, Table A1: Revenue From Privately Owned Forestland on page 12.

The analysis above covers property taxes and timber harvest taxes of all types. The severe decline of taxes paid by the timber industry are concentrated in taxes on the harvest of timber. Over a fifteen year period the Oregon Legislature ramped down taxes on timber harvest. The reduction of timber harvest taxes ended timberland support for local governments (schools, counties, etc.). See our analysis below.

The tables above demonstrate that during a period when timberlands transitioned to TIMO and REIT ownership, to avoid federal income tax, the state of Oregon greatly reduced property and forest harvest taxes for the same corporate owners. What these changes in taxation produced was an increase in profits to timberland investors (the owners of U.S. equities) and a reduction in cash flowing to local communities in support of public services. 90% of U.S. equities are owned by the richest 10% of the population. 25% of U.S. equities are owned by foreign owners – the wealthy of the world.

The above train wreck of public policy is just one facet of an ugly diamond that pits people against people in rural communities and places water quality and carbon dense primary forests at risk. All of the change in taxation occurred out of public view and unopposed by almost all elected officials of both major parties. Most assuredly, Oregon’s political system is polluted by money.